The unique identification of a customer and the processing of complete, accurate and timely customer data are of vital importance in the corporate and investment banking service industry. However, many banks struggle to keep up with the changing demands and preferences of their corporate customers.

A recent survey found that 46% of corporate customers are less than satisfied with their banker’s ability to support new customer on-boarding with more than 60% of issues linked to accuracy, documentation and duration; areas in which timely access to complete, accurate and insightful information is key. Banks wishing to identify growth opportunities by industry, by segment and by product find it challenging to support their relationship managers with reconciled information from across the entire business.

Often this is due to products and their associated transactions being managed in business and technical silos. As a result, corporate customers wishing to use multiple products over various locations may find themselves frustrated at the lack of clarity offered by the bank brought about by the different supporting procedures, processes, organisations and people that take place in the background of an operation.

How to turn your business into a customer-focused organisation

Improving collaboration between customer relationship managers and product sales teams is essential to the development of a customer-focused business. But what about applications and their data? How does that become customer-focused?

While merging and integrating applications might be a long-term and perhaps expensive option, joining together the information can help a product-focused organisation take a significant step towards becoming a customer-centric organisation. In such an approach, particular attention needs to be given to understanding how to join information in a way that it can be trusted and shared across organisational boundaries. This is certainly true of counterparty information that, while perfectly fine in its own business silo, now needs to find new meaning and value at a corporate level.

Master data management is key to create a unified customer view

Master data management is a key component of a solution for providing a single, trusted view of business-critical information. A key advantage is that existing data sources and silos can remain in place while the master data management solution does the hard work of transforming this data into high quality, ready-to-use information.

Once a unified, trusted and governed view of customer information can be found, its value can be enhanced through the addition of other trusted information sources, some of which might even emanate from outside of the organisation. For example, adding D-U-N-S information might help support the creation of legal, risk, credit and marketing hierarchies to multiple levels that might then be shared uniformly across the organisation. Improvements in the quality and availability of business critical information can also help reduce administrative expenses to drive efficiency and deal with ever increasing demands from the regulators for Know Your Customer (KYC) and Customer Due Diligence (CDD) procedures.

Improving the ability to collect, govern, complement and share key business information is at the heart of the transformation from a product-centric to a customer-centric organisation, one that is able to actively market to and retain profitable, high-value customers. It is important to bear in mind, however, that it is the results that matter most. The customer is not interested in why a process works efficiently – they are just happy that it does.

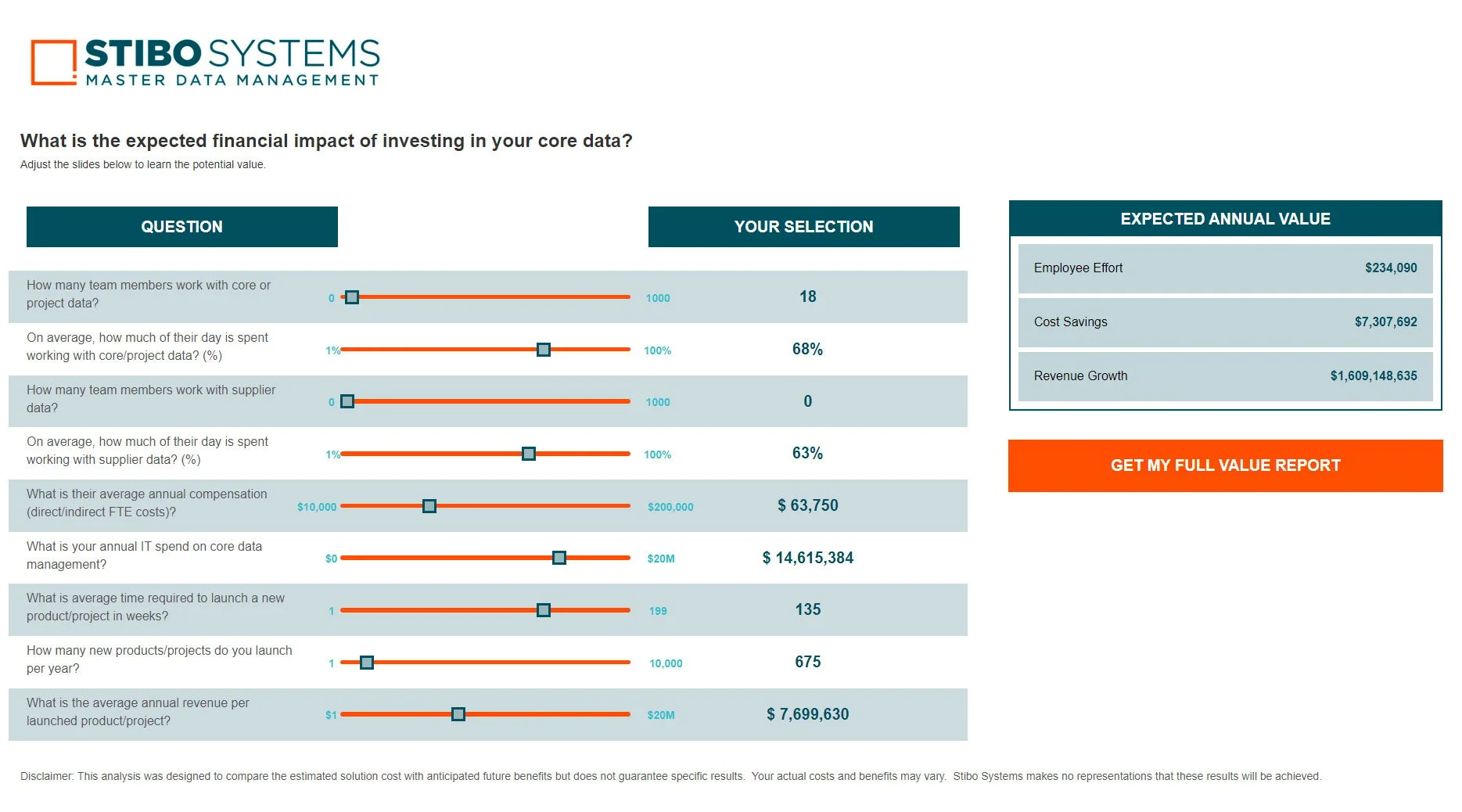

Are you considering investing in customer master data management?

Calculate Now

Estimate the ROI of your customer master data management project.

What are the benefits of creating a unified customer view?

Creating a unified customer view means that all of the information about your customers is gathered in one place, so that you can make decisions based on the big picture. Having such unified customer view gives you the following six major benefits:

- Eliminates data duplication and reduces errors

- A better understanding of each of your customers

- Improves personalization opportunities

- More targeted and efficient marketing campaigns

- Faster and better resolution of customer service inquiries

- A better customer experience and improved customer loyalty

3 tips on how to analyze your customer data with customer master data management:

-

Audit where customer information is located, how it is defined, understood, used and shared, and where it falls short on supporting business functions.

-

Identify metrics and KPI’s for both a better business outcome and an improvement in the quality of customer information.

-

Define and implement an information governance policy supported by appropriate tools and an organisation that is accountable.

Book a free product demo today and explore more about how to effectively analyze customer data with customer master data management.